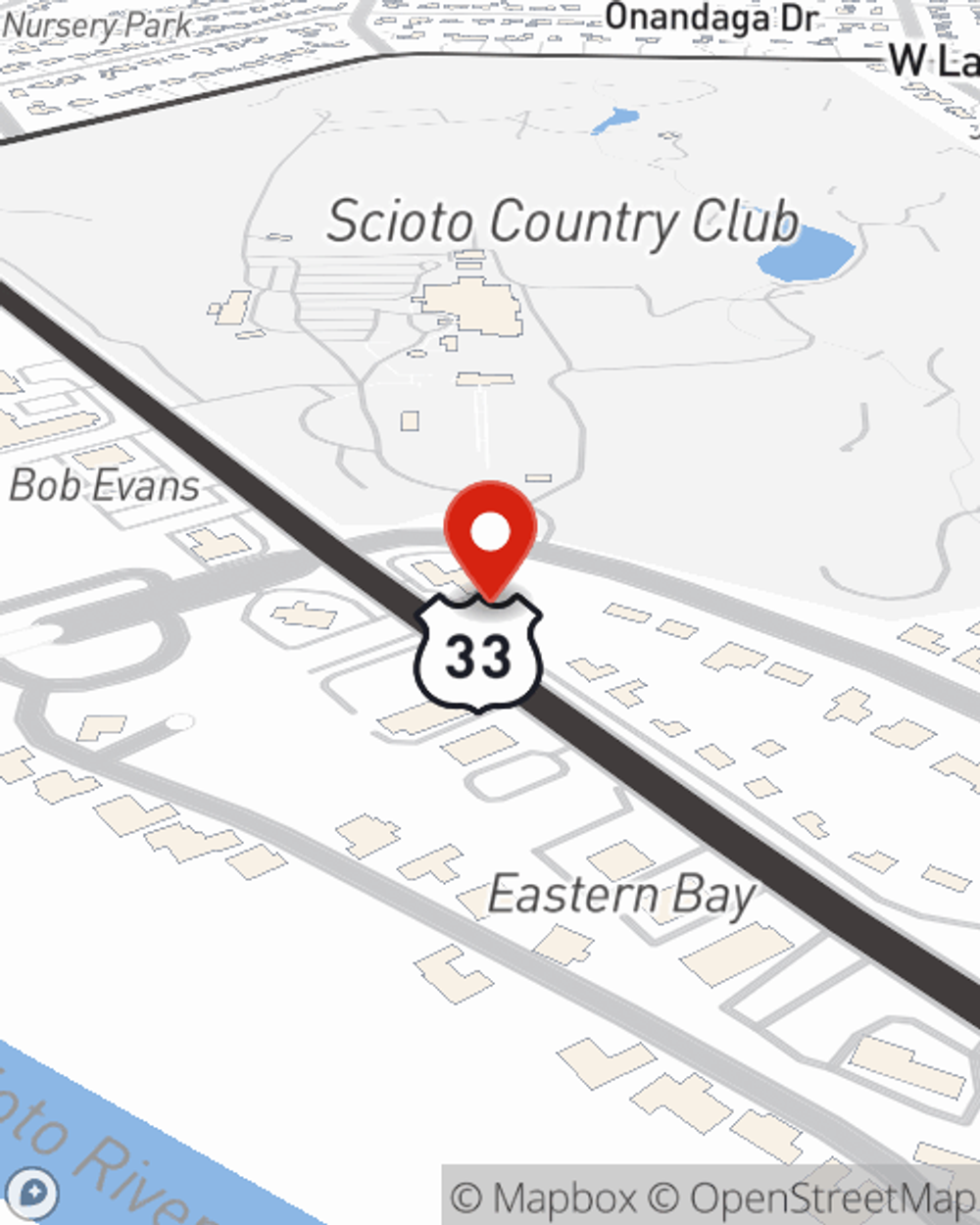

Business Insurance in and around Columbus

Calling all small business owners of Columbus!

This small business insurance is not risky

- Columbus

- Upper Arlington

- Hilliard

- Dublin

- Worthington

- Bexley

- Grove City

- Powell

- Westerville

- Gahanna

- White Hall

- Reynoldsburg

- Blacklick

- Franklin County

- Delaware County

- Madison County

- Pickaway County

- Delaware

- Marysville

- Pickerington

- Pataskala

- Fairfield County

- Licking County

- Union County

Help Prepare Your Business For The Unexpected.

It takes courage to start your own business, and it also takes courage to admit when you might need support. State Farm is here to help with your business insurance needs. With options like a surety or fidelity bond, business continuity plans and extra liability coverage, you can rest assured that your small business is properly protected.

Calling all small business owners of Columbus!

This small business insurance is not risky

Protect Your Business With State Farm

Whether you own a beauty salon, a donut shop or a bakery, State Farm is here to help. Aside from fantastic service all around, you can customize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Agent Katie Rider is here to explore your business insurance options with you. Contact Katie Rider today!

Simple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Katie Rider

State Farm® Insurance AgentSimple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.